Hayfin is pleased to announce that its $355 million bilateral acquisition facility for V.Group’s buyout by STAR Capital and Ackermans & van Haaren has been named as the ‘Private Credit Deal of the Year’ 2024 by Marine Money. Leveraging its expertise in corporate lending and maritime finance, Hayfin developed a sophisticated private credit solution based on its deep understanding of industry dynamics, the growing call upon third-party managers due to increased regulation and technical demands, and the inherent resilience in a business of V.Group’s scale.

The loan blends Hayfin’s maritime expertise with structured credit and is backed by operational sustainability and predictable revenue streams. It’s testament to the team’s unique in-house capabilities and industry experience that they have been able to translate a strategic partnership into a creative credit solution.

As global shipping evolves and faces new challenges, the sector will require flexible financing. Hayfin is uniquely placed to meet that demand and will continue to work with borrowers, investors and clients as they navigate the maritime market.

Hayfin is pleased to announce that Sumitomo Mitsui Trust Bank, Limited (“SuMi TRUST Bank”), a leading Tokyo-headquartered bank, has invested in Hayfin’s Maritime Yield strategy, bringing total strategy commitments to over $620 million across the commingled fund and related separately managed accounts.

The investment is the latest addition to the c.$400m in capital commitments raised for the fund in 2023 and has taken Hayfin’s total deployment capacity significantly past $1bn when coupled with conservative debt financing.

This latest fundraising round is a further extension of Hayfin’s track record in the maritime sector, having invested in excess of $4 billion across various sectors – dry bulk, tankers, containers, LPG, and LNG. The firm has deployed capital into the sector through its private credit strategies, as well as the Maritime Yield strategy, which focuses on building a diversified asset-owning platform, generating long-term, stable income.

SuMi TRUST Bank’s commitment will directly support the development of sustainable maritime transportation through the Hayfin Maritime Yield strategy. The investment underlines the gaining momentum for decarbonisation of the shipping industry, both within local markets and globally. It will strengthen networks between the maritime industry and financial markets while developing a collaborative relationship with Hayfin’s Japan team.

Andreas Povlsen, Head of Maritime, commented: “We’re delighted to have secured this important commitment from SuMi TRUST Bank, underlining our lasting commitment to the Japanese market through our Maritime Yield strategy – not just investors, but also shipbuilders, operators, leasing companies and trading houses. Our maritime platform offers exposure to high-quality assets that help underpin global trade flows and is working to drive forward the decarbonisation of the global shipping sector, which is a proposition that increasingly resonates with institutions in Japan and elsewhere around the globe.”

Hayfin is pleased to announce that, through its Direct Lending strategy, it has provided fully underwritten debt financing to support the acquisition of V.Group by a consortium led by STAR Capital. Hayfin’s support for the acquisition extends its long-standing relationship with V.Group and its management team, having been a lender to the business since 2020.

V.Group is a global provider of mission-critical services to the maritime industry, such as technical ship and crew management, crew welfare services (e.g. catering, travel, and digital wallets & payment cards), leveraged procurement, technical services, specialist insurance broking, and modern shipping-specific digital solutions.

Headquartered in London, it has a global presence with 50 offices across 30 countries and employs c. 2,900 employees worldwide. In addition, the group has access to the world’s largest international network of over 44,000 seafarers to provide its clients with professional crews. It currently services approximately 3,500 vessels from pedigree shipowners and managers alike, with safety and compliance at the heart of V.Group’s operating model.

Andreas Povlsen, Head of Maritime at Hayfin, comments: “This latest investment builds on Hayfin’s track record in the shipping sector and is the direct result of strong collaboration between our specialist maritime team and the broader Private Credit platform focused on originating corporate lending opportunities. We are delighted to continue our journey with V.Group alongside its impressive management team and its new partners in the consortium led by STAR Capital.”

Disclosure

Past performance is not a guarantee of future performance. No investment, strategy or tested process can guarantee results. Please note, fees reduce returns to investors.

Hayfin today announces that it has signed a contract with Oshima Shipbuilding and Sumisho Marine to construct two new-build 100,000-DWT Post-Panamax dry bulk carrier ships. The vessels, once constructed, will be deliver to an international energy trader on a long-term charter. The project will be funded through Hayfin’s Maritime Yield strategy and underlines the firm’s commitment to the Japanese shipping market, as both an asset-owner and long-term charter provider. The vessels will be managed by Hayfin’s in-house ship management platform, Greenheart Shipping.

The vessels will be constructed at Oshima Shipyard in the Nagasaki Prefecture of south-western Japan and completion is expected to take place within 2026. The vessels will be built to world-leading standards of quality and fuel efficiency, differentiating them from the majority of the current global Panamax fleet that is expected to be non-compliant with International Maritime Organisation sustainability regulations in three years’ time. With just two Japanese shipyards currently building Post-Panamax vessels, contributing to a historically low global orderbook, Hayfin was able to secure these two highly sought-after slots at one of the world’s leading dry bulk specialists through its longstanding relationships with key stakeholders in the Japanese market.

Andreas Povlsen, Head of Maritime at Hayfin, said: “This transaction is another sign of our firm commitment to the Japanese market and demonstrates the kind of attractive asset exposure we can offer to investors through our Maritime Yield strategy; combining fuel-efficient assets and long-term charters to investment-grade counterparties against a supportive long-term market backdrop with consistent tonne-mile growth and a fleet in urgent need of renewal.”

Hayfin recently announced a successful fundraise for its Maritime Yield strategy, equipping the firm with the capacity to acquire $1 billion in shipping assets through equity and debt financing, with a focus on top-specification assets that generate predictable and uncorrelated cash yields from blue-chip counterparties. Having been active in Japan since 2015, Hayfin also opened its Tokyo office last year, led by Tomohiro Hosogaya, the firm’s Head of Japan.

Shipping is a critical component of downstream supply chains, transporting commodities and finished goods valued at over USD20 trillion in 2023.

A strategically important waterway, the Suez Canal (constructed in 1869), reduces travel distances meaningfully. The canal connects the Mediterranean Sea to the Red Sea with approximately 10% of global seaborne trade transiting the Suez Canal and hence the Red Sea.

Over the last few months, tensions in the Middle East have forced trade flow diversions to avoid the Red Sea. This has resulted in expanded tonne miles, increasing asset utilisation rates and has driven up charter rates and dividend yields.

Overview

Whilst Hayfin does not have vessels within its fleet which are scheduled to transit the Red Sea, and we retain the ability in our contracts to reject any request to trade these waters, we expect the current market dynamics of expanding tonne miles and elevated asset utilisation rates to be persistent forces over the medium to longer term.

By exploring the history, geography, and commercial impacts we can better understand real time developments and current and ongoing shift in market dynamics.

Over the last few months, tensions in the Middle East have forced trade flow diversions to avoid the Red Sea expanding tonne miles, increasing asset utilisation rates, and driving up charter rates and dividend yields.

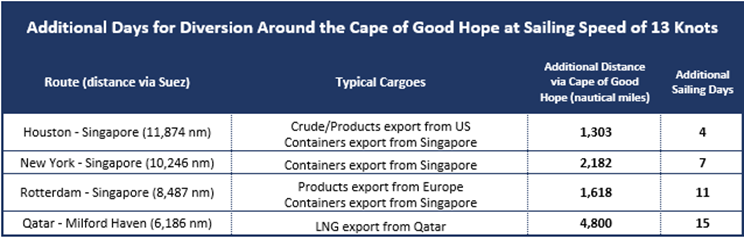

The table below illustrates increased sailing distances and voyage lengths for certain key routes.

At a sailing speed of 13 knots, diversions around the Cape of Good Hope can add up to 15 days in voyage duration, having a knock-on effect on charter rates, insurance premiums and fuel pricing/logistics.

- ‘War risk’ insurance premiums for Red Sea transits have risen by up to 10x.

- Availability of low sulphur fuel oil (‘LSFO’) at key bunkering hubs is a delicate balance; since mid-December 2023 pricing of LSFO in Durban, South Africa has increased 4.0x versus Rotterdam LSFO pricing.

Another consequence of recent disruption is that the proportion of Chinese owned ships transiting the Red Sea has increased significantly i.e. it is ‘western’ ships that are diverting around the Cape of Good Hope, further illustrating the impact of geopolitics in the conflict.

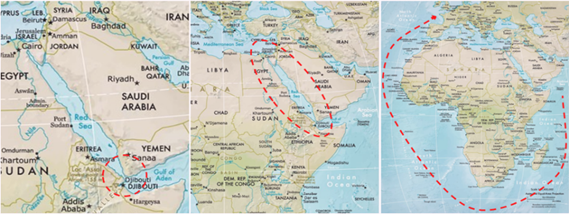

Geography

- Situated between the Arabian Peninsula and East Africa, the Red Sea provides access to Israel’s only port, Eliat, via the Gulf of Aqaba. At the southern end of the Red Sea lies the Bab-el- Mandeb Strait, bordered to the east by Yemen, and both Eritrea and Djibouti to the west.

- At its narrowest point, the Bab-el Mandeb Strait is just 21 miles wide, which is a similar width to the English Channel or approximately 20% of the distance between Florida and Cuba.

- Beyond the Red Sea, lies the Gulf of Aden, bordered by Yemen to the north and Somalia to the south.

Since the hijacking by Houthi militia of the Car Carrier Galaxy Leader (a vessel with links to Israel) on 19th November 2023 in a military operation involving the landing of heavily armed assailants aboard the vessel by helicopter, there have been around 30 attacks against ships transiting through the Red Sea. After what seemed to be an initial focus on vessels with links to Israel or simply calling at Israeli ports, the attacks have seemingly become increasingly sporadic and arbitrary, mostly against ships with no particular nexus to Israel.

As a result of these attacks, the United Nations Security Council has adopted Resolution 272 demanding the Houthis end their attacks and noting “the right of Member States, in accordance with international law, to defend their vessels from attacks.” Consequently, the US and its allies launched Operation Prosperity Guardian, deploying significant naval assets to the region, and launching a series of strikes against land-based targets in Yemen. In retaliation to these actions, the Houthis have shifted focus, attacking ships sailing in the Gulf of Aden off Yemen’s southern coast. This included a missile strike against the Gibraltar Eagle, a Bulk Carrier controlled by US- based Eagle Bulk Shipping, when it was located 90 miles southeast of Aden.

Commercial Impact

The threat posed by these attacks has forced diversions to avoid the Red Sea. Several shipping companies have publicly stated that they will no longer transit the Red Sea.

- It is estimated that since mid-December 2023, Containership arrivals in the Gulf of Arden have fallen 90%, Car Carriers 94%, Tankers 46%, Gas Carriers 86%, and Dry Bulk, least affected, at a 24% decline.

- These diversions also increase the complexity of voyage planning, particularly in terms of sourcing the availability of bunkers (ship fuel). Bunkering is available in South Africa, but supply is limited, and fuel costs are high. For example, as of 18 th January 2024, a metric tonne of LSFO cost USD537 in Rotterdam, USD600 in Singapore, and USD780 in Cape Town.

- The increase in tonne miles has in turn impacted the cost of freight. At the end of September 2023, the Shanghai Composite Containerised Freight Index (the barometer of the seaborne cost of shipping containers from China to global markets) settled at a post-pandemic low of 886.9. By the middle of November, it had risen to 1,000, and has since doubled, reaching 2,206 on 12th January 2024. In product tanker trades, we have seen evidence that spot rates for voyages that would usually pass through the Suez Canal have risen 30-50% since mid-December. Spot rates for long range and medium range product tankers have risen 33% and 29% respectively in the week ending 19th January 2024 alone.

- The southern reaches of the Red Sea have, for some time, been designated a “High Risk Area” for insurance purposes requiring ship owners to pay additional premium for transits. On 18th December 2023, the Joint War Committee at Lloyd’s of London extended the High-Risk Area from 15 degrees to 18 degrees, broadly to encompass the entire lower third of the Red Sea. War risk premiums for Red Sea transits have risen 10x from 0.075% – 0.125% in early December, to 0.5% – 0.75% of the hull value.

- There is also a human impact upon crew members forced to sail in the Red Sea. The crew of both the Galaxy Leader and the St. Nikolas, comprising Ukrainian, Bulgarian, Filipino, Greek, and Mexican nationals are still being held hostage.

Conclusion

Supply chains operate with delicate equilibriums, and delays or disruption tend to increase pricing, benefiting ship owners but perpetuating commodity price inflation.

We have experienced these dynamics several times recently with the trade disruptions during the Covid 19 period, the Suez Canal blockage in 2021 due to the Ever Given, the drought implications in the Panama Canal and the profound impact of shifting energy flows due to the Russia/Ukraine conflict.

The current market dynamics are no different. Since Q4 we have seen increases in the Shanghai Composite Containerised Freight Index by 2.5x. In the same period spot rates on certain refined product tanker trades have increased by up to 50%.

Unlike fixed physical infrastructure, m aritime assets are liquid and dynamic. This is evidenced by shifting trade flows away from the Red Sea and the Suez Canal, instead taking the long route around the Cape of Good Hope as those with interest in ships seek to protect their crews, assets, and cargoes. This drives up freight costs and tightens shipping markets due to increased tonne mile demand.

Persistent trade flow disruptions and expanding ton miles are expected to remain a more permanent feature within supply chains and these market dynamics, on top of healthy long term demand fundamentals, are expected to exacerbate supply/demand imbalances and could likely lead to sharper or longer periods of elevated rates and higher asset yields. When considering these fundamentals against portfolio construction considerations, staggered duration charter contracts across a diversified hard asset base as well as “index-linked” or profit share structures are well positioned to capture these gains and dividend streams.

The kind of interruption to maritime trade that we are currently seeing in the Red Sea has a wide range of ramifications. This includes, first and foremost, the crew members and civilians endangered or otherwise directly impacted by the instability in the region. It also affects consumers and businesses in the form of higher commodity prices and freight costs. But for shipowners and other maritime investors, supply chain disruption can drive up rates and therefore boost yields. This combination of favourable pricing dynamics and a more challenging operating environment looks set to remain a feature of the shipping industry in the medium to long term – layered on top of a longstanding and fundamental supply -demand imbalance that is the primary driver of investor interest in the shipping market.